You can be approved for auto finance at a dealership within hours if you have a strong application and a competent in-house finance broker.

There are many variations to both of these elements that will determine the speed of approval.

Lenders can also vary in processing time. A big-4 bank is usually going to take longer than a specialised non-bank lender.

In this article, we will discuss some realistic timeframes and the elements that go into a lightning-fast approval.

The Critical Question!

When you apply for finance through a dealership, the biggest influence over the quality of the outcome is the competency of the person you are dealing with.

You must ask:

“Who is organising the dealership finance?”

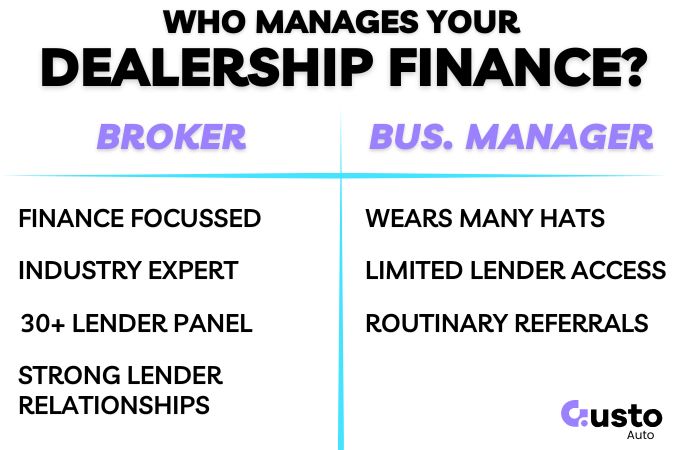

There are usually two answers to this question, and while there are good and bad operators in all professions, if I were to generalise, these would be the answers to consider.

Business Manager

They will know their way around an application and have a couple of lenders they refer deals to.

They often do what is familiar and routine. They are well-meaning and intend to be as helpful as possible, but may not have the deep expertise needed to get the best outcome.

Their priority is selling the car, and organising finance is an add-on rather than their main business.

Asset Finance Broker

This person lives and breathes auto finance and settles tens of deals per week from a range of different sources.

They have access to a panel of 30+ lenders that includes everything from big 4 banks, to credit unions, to slick non-banks, to specialised bad credit lenders.

A big part of their expertise is knowing the credit policies of all lenders on their panel. This allows them to match you with the most suitable lender to maximsie your chance of approval.

But the biggest benefit is their working relationship with each lender, which allows them to discuss potential issues with an application and workshop solutions.

This can often turn a rejection into an approval if certain conditions can be met.

Add up all of this, and you will be getting faster outcomes combined with a higher chance of loan approval.

Car Loan Application Process Timeframes

Below is a brief summary of the full car loan approval process along wth an indicative timeframe for each stage.

This will help you understand where the friction points can be.

While it may sound like a lot, we have successfully navigated this process in a matter of hours when all things are in order.

Step 1: Preliminary Assessment (10-20 minutes)

You can sit down with the broker on-site at the dealership to conduct a preliminary assessment of your financial circumstances.

They will then present the most suitable loan options to you before progressing to a formal application.

Step 2: Submitting Your Application (10-60 minutes)

The broker will request any additional information that is required by that specific lender to ensure a complete application is submitted.

Checks will be done for accuracy to minimise the chance of unnecessary back-and-forth with the lender.

It is then time to submit your application.

Step 3: The Lender’s Review (From Minutes to Days)

This step is entirely dependent on the backlog of applications with the lender.

The broker will have a general idea of response times, and if there is an urgent need to resolve quickly, they may be able to request the application be expedited.

Once your application is at the front of the queue, then it should be a short turnaround due to the completeness of the application preparation.

Step 4: Final Approval (30 Minutes)

If the lender is satisfied with the application, they’ll issue the approval and issue loan contracts.

As part of this, invoices for the vehicle purchase should also be provided to the lender. Your dealership and broker will take care of this step for you.

Now you just need to sign the contracts and finalise any other paperwork to meet the conditions of the approval, if any.

Step 5: Settlement

Now the funds can be released by the lender to the dealership and the vehicle can be prepared for collection.

You are now ready to pick up your new car!

Gusto Auto Customer Case Study

Below is a real example where a customer came to Gusto Auto to purchase a vehicle and applied for finance through our sister brokerage, Gusto Finance.

In this case, same-day approval and settlement was achieved through the dealership.

Here is a summary of the timeline achieved:

- 9am: Initial inquiry received for a $13,000 car loan.

- 9:10am: Customer contacted by Gusto Finance by to conduct a preliminary assessment and discuss loan options.

- 10am: Complete loan application submitted to the lender.

- 10.30am: Decided on the car he wanted to purchase.

- 3pm: Application conditionally approved.

- 5pm: Loan settlement finalised!

- 5:30pm: Customer drove away in their new car – hours after the initial inquiry!

While this speedy outcome is not always achievable, it is certainly possible if you are well prepared and need a fast approval.

What Will Slow Down Your Dealership Application

The following things are the most common causes of delays in your car loan application.

Lack of Transparency

All of the financial information in your application will be verified as part of the assessment process.

If you leave out important details, then this could lead to the lender requesting additional documentation later in the process.

This will delay the final assessment.

Incomplete Documentation

Your broker will be unable to submit a full application until you have provided ALL of the requested paperwork.

You cannot send some of the documents so “they can get started.” It doesn’t work that way – an assessment requires all paperwork for submission.

Submitting this as quickly as possible will be your best chance of a rapid approval.

Slow Communication of Issues

When a lender has additional queries then the broker will pass them on to you immediately.

Make sure you are contactable by phone while you have a live application to ensure a speedy resolution.

Conclusion

If you have a good credit score and can afford the loan your application can usually be approved quickly once submitted via the dealership.

Delays often come from previous credit issues that warrant a more thorough review of an applicant’s finances.

This can often involve the submission of bank statements, but in most cases, this is not necessary.

If you want to save time on the day, you could also seek a loan pre-approval and take care of most of the process prior to visiting the dealership.

You can start this process by clicking the finance quote button above.