When paying a holding deposit to a dealership there is a informal agreement that the car will be reserved for you until further notice.

It is not a legal obligation and it is implied that both parties act in good faith.

But how long is this expectation reasonable if you have not come back to complete the transaction?

In this article, we will discuss how long a dealership is likely to hold a car for you with a deposit, and what to do if that deadline approaches before you are ready.

What is a Holding Deposit

A holding deposit is a refundable amount taken by a dealership to temporarily take a vehicle off the market.

This is to show that you intend to buy the vehicle and that you do not want them to offer it to anyone else.

While any agreement to hold the car is non-binding, it is in both parties interest to uphold their end and follow through with the transaction.

How Much is Required for a Deposit

Only a modest sum is required as a holding deposit when buying a used car. The exact amount can be negotiated between the buyer and the dealership.

The amount must be substantial enough for the dealership to be satisfied of the intention to complete the transaction in the near future.

Some customers volunteer a larger amount when they intend on paying a meaningful sum towards the purchase of the car.

But this goes beyond the scope of a holding deposit.

The balance is then settled through finance, which is why they need some additional time to finalise the loan.

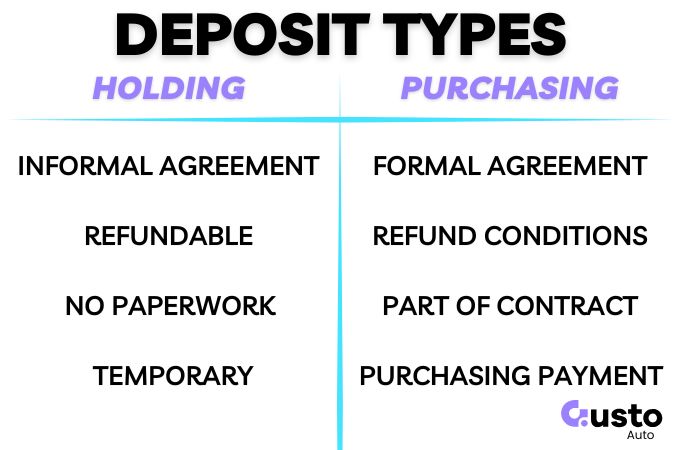

Holding Deposit vs Purchase Deposit

A holding deposit is essentially a reservation fee. It prevents the dealership from selling the car to someone else for a set period.

If the funds are to form part of the eventual transaction then this is a purchase deposit.

In that scenario where a customer intends on paying a material amount towards the purchase price then they may not mind paying a larger deposit upfront.

The balance may be coming from alternative sources, such as a car loan that is still be finalised.

The amount paid would be a purchase deposit rather than a holding deposit, which would be refunded later on.

This is an important distinction as as purchase deposit could be forfeited if you later decide to withdraw from the purchase.

A written agreement will be in place detailing the terms of a purchase agreement and the conditions for refund.

Why Dealerships Ask for a Deposit

Dealerships request deposits to protect themselves from customers who may express interest but aren’t ready to commit.

The deposit filters out casual enquiries and ensures genuine buyers have priority.

For the customer, it also provides peace of mind, securing the vehicle while details are ironed out.

The last thing they want is to invest time inspecting a vehicle, organising funds and paperwork, only to have it sold out from underneath them.

How Long a Dealership Will Typically Hold a Car

Most dealerships in Australia will typically hold a car for anywhere between 24 hours and 72 hours, depending on the context of discussions up until this point.

Some may be comfortable with a week if there are very specific circumstances.

The longer the time period, the more risk the dealership is taking on that you may change your mind and they have missed sales opportunities while waiting for you.

The specifics will be influenced by the following factors.

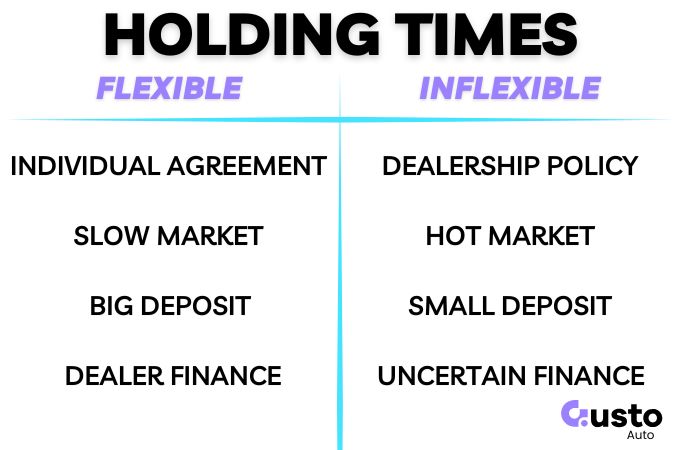

Dealership Policies

A larger franchise dealership is likely to operate under stricter guidelines than the small business operator.

Both scenarios should have some room to negotiate, but the larger operation is likely to have a firm guideline placing guardrails on what is possible.

A smaller operator could accommodate a longer hold period, but could be equally likely to just say no to any holding period.

Market Demand

If market activity is high and cars to turning over quickly then an extended holding period is unlikely.

In the midst of the pandemic, new cars were as rare as hens teeth, and demand was pushed into used cars out of necessity.

Long holding periods were non-existent with buyers flooding the market.

While things have normalised since then there are certain makes and models that remain in hot demand to this day.

Paying a holding deposit is smart to lock in that high demand vehicle, but you also need to move fast to take ownership or it will not be around long.

Size of Your Deposit

A $50 deposit and a non-responsive buyer is much more likely to be cast aside then someone who has committed a few hundred and is actively progressing to completion.

A larger deposit often shows stronger intent, giving you more leverage when negotiating hold times.

Dealers are more inclined to give additional breathing room when a buyer demonstrates serious commitment.

Dealer Finance Application

If you have applied for finance through the dealership then they are actively working on your behalf to complete the sale.

In this circumstance there is likely to be no time pressure at all as dealership is involved in the process and will be aware of the progress and likely conclusion.

A dealer will also earn a commission from a lender when they secure an approval and settle the loan. So they are more likely to be flexible as long as you are doing your part to move the application forward.

What If You Need More Time?

If you are not ready to complete the sale by the deadline discussed with the dealership you should have an immediate conversation to discuss next steps.

If you become unresponsive and the dealership is left in the dark then expect the deposit to be refunded and the car placed back on the market.

Given that a holding deposit is there to support an informal agreement you do not have any recourse if this happens.

Your best chance of working out an extension is transparency and honest communication. You never know, the sales people may be able to help you resolve whatever the issue is.

Especially if there is an issue completing the financing arrangements with a third party, or directly with a lender.

This is an area where industry knowledge is worth its weight in gold!

Our brokers get much more information throughout an application and can workshop solutions, whereas a direct consumer application often results in an approval or a rejection. No inbetween.

Click below to get in touch with our finance team and explore your options.

What Happens to my Deposit If I Withdraw?

If you decide to withdraw from the sale then your holding deposit will be refunded.

Any reputable dealership will process this payment immediately and it should be in your account within 24 hours.

We have heard of larger dealerships having a whole process that can take a week or two to process a refund.

But you will get it back at the end of the day, unless it is a non-refundable purchase deposit – that comes with paperwork.

Conclusion

A holding deposit is a tool you can use to show that you are a serious buyer and you just need to organise funds to complete the transaction.

Most dealerships are happy to give you the time to do this so you are not frantically rushing under the threat of the car being sold elsewhere.

However, it is a two way street and once your holding deposit has been accepted you should seek to complete the sale as quickly as possible.

I am sure you are dying to drive away in your new wheels anyway!