When applying for finance through a dealership your application will usually be referred to a lender via a finance broker or business manager.

The broker will have access to a large number of lenders, including some that will specialise in bad credit car loans.

So yes, it is possible to get a loan through a dealership with bad credit. However, they do not lend to everyone!

In this article, how to qualify for finance if you have had credit problems in the past.

What is Bad Credit in Australia?

Bad credit is usually associated with someone who has failed to repay debts in the past. This usually means that they are a higher risk of missing repayments in the future.

However, there are multiple ways that someone could be deemed high risk even if they have not missed a repayment on a loan.

Low Credit Score

A credit score is determined by the summation of activity on your credit file.

Positive events like applying for a mortgage, being approved, and successfully making every repayment would boost your score.

Low quality activity like payday loan applications, missed loan repayments, or arrears on utility bills can all detract from your score.

Whether a score is good or bad is determined be each lender’s credit policies and is often the first eligibility requirement to meet.

If you are below their cutoff then you will often be rejected without further assessment.

This is why a broker will run a credit check early in your application when applying through the dealership.

It will allow them to help you find the lender who will consider your application.

Limited Credit History

For some lenders, no activity is the next worst thing to bad history.

It takes time to build a reliable track record of repaying debt, which in turns will build a strong credit score.

Those who are young and have not had a loan before, or those who are new to the country, can often be categorised as high risk. Even though they have done nothing wrong.

While this may sound unfair, remember that a credit score is a predictor of future risk. If you have no history to measure, then the uncertainty equals higher risk for the lender.

Poor Financial Behaviours

Outside of a credit file, there are also a number of red flags that could place you in a higher risk category.

These are only visible on your bank statements and lenders tend to only look there if they have a reason to (such as a low credit score).

If your finances are improving this can be a big win for you, but if not then there is nowhere to hide.

If you are reversing on direct debit payments, incurring bank fees, and going into a negative account balance, then this is a sign that you may be struggling to manage your budget.

Excessive repayments to Buy Now, Pay Later services, or Wage Advance apps, could also be a big red flag that is only visible on your bank statements.

Causes of a Bad Credit History

The most common reasons that people have bad credit is due to either missed repayments on previous loans or utility expenses or frequently using loan products that could indicate someone is struggling financially.

Missing Debt Repayments

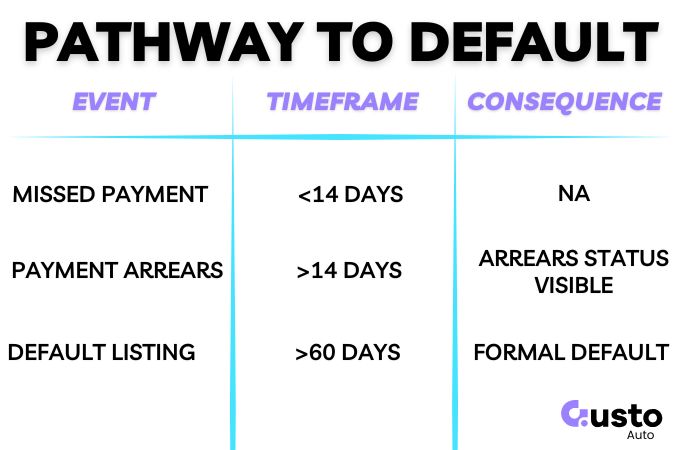

If you miss a loan repayment and fall into arrears this will be visible on your credit file very quickly.

Your Comprehensive Credit Report could have a recorded missed payment is a little as 14 days!

And that history of arrears will be visible even after you make up the payment. But there are multiple levels to how serious missed payment can be:

- Missed payment: Make it up in under 14 days and no harm done.

- Payment Default: Can be listed after 60 days and will stay on your credit file for five years.

- Court Judgment: A lender has taken you to court and obtained a judgment to attempt to recover the money from you through various enforcement methods.

- Bankruptcy: While there are many forms of bankruptcy, for the purpose of this article just know its bad for your credit.

Use of Short-Term Loan Products

Regular applications for short term loan products can be a sign that you are not managing your household budget well.

This is a big red flag for lenders!

Payday loans are now more commonly referred to as Small Amount Credit Contracts in Australia, or SACCs.

If you have used these more than once in the last 12-24 months then some lenders will not touch you.

However, the broker at the dealership will be able to find you some options if the frequency is below the various thresholds and you have eased up in the last six months.

Will Bad Credit Stop You Getting a Loan at a Dealership?

As you will have learned so far, there are so many variations to a credit score, credit history, and lender policies across the industry that a broker can only determine this on a case by case basis.

For many the answer is yes!

However, a no would always be an accompanied with a plan of action and a timeline for when you may qualify again.

In most cases you can tidy up some basic behaviours and be eligible in just a few months.

Our broker team are experts in bad credit car loans and if you can qualify for a loan we will find the right place for you.

To get in touch with the team click the button below to get started.

How to Improve Your Loan Application

Lenders who consider those with a poor credit history will also consider other elements of your financial profile.

If you have enough other positive factors, it can overcome negatives evident on your credit file.

- Stability of income.

- Sound expense management.

- Surplus funds at the end of each pay period.

- Accrued savings in a bank account.

- Improved recent repayment history on other debts

- Ensure all current loans are up to date

- Do not use Wage Advance products

- Minimise use of BNPL (avoid it if possible)

- Ensure no payment reversals on your bank account

It all comes back to demonstrating that you can manage your finances well and are capable of taking on extra repayments comfortably.

Conclusion

If you know that you have had problems repaying debt in the past that may have impacted your credit file then you should look for a pre-approval before you arrive at the dealership.

Our team can get you started so you know where you stand before you have your heart set on a new vehicle.

However, an application can be done same day at the dealership once you have found your next set of wheels.

You may be surprised how quickly we can turn around your application, even if you have bad credit.